The False Claims Act is a powerful legal tool designed to combat fraud against the government. It allows individuals and entities to report fraudulent activities that involve government funds and programs. In addition to the federal False Claims Act, many states have recognized the importance of having their own versions of these acts to address fraud relating to state or local funds within their respective jurisdictions. These state-specific False Claims Acts function similarly to the federal law, but they may have unique provisions, requirements, and procedures. This means that potential cases involving state-specific claims require a keen awareness of these nuances.

Zimmerman Reed’s legal team is well-equipped to handle cases involving both federal and state False Claims Acts. With our extensive experience, we can guide you through the intricacies of these laws, ensuring that your case is approached comprehensively and effectively. Our commitment to justice, combined with our in-depth knowledge of the legal landscape, makes us a reliable partner for individuals and entities seeking to address fraud-related matters.

Whether you’re dealing with issues falling under the federal False Claims Act or navigating the complexities of state-specific False Claims Acts, Zimmerman Reed is prepared to provide you with expert legal counsel and representation.

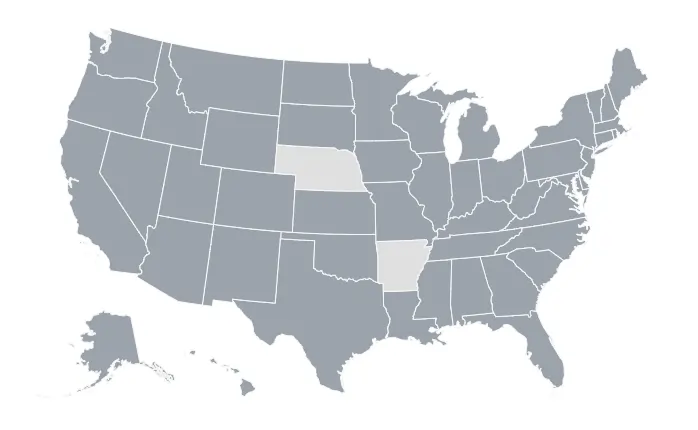

An overview of state False Claims Acts with Qui Tam provisions allowing for private actions by whistleblowers is below. This overview is provided for informational purposes only and is not legal advice. Due to the ever-evolving nature of state laws across the country, if you have a question about fraud against the government in any state, please contact the False Claims Act team at Zimmerman Reed for an evaluation of how the law may apply to your case.

Alabama

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Alaska

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Arizona

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Arkansas

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

California

California False Claims Act, Cal. Gov’t Code §§ 12650 et seq.

The California False Claims Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state or its political subdivisions, including cities, counties, and other local entities.

If successful, a whistleblower may receive between 15% and 33% of the proceeds or settlement of an action in which the state or political subdivision intervenes, or between 25% and 50% of the proceeds if the state or political subdivision does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Colorado

Colorado False Claims Act, Colo. Rev. Stat. §§ 24-31-1201 et seq.

Colorado Medicaid False Claims Act, Colo. Rev. Stat. §§ 25.5-4-303.5 et seq.

The Colorado False Claims Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state. While the Colorado False Claims Act contains an exception for claims related to Medicaid funds, those claims are covered by the Colorado Medicaid False Claims Act.

If successful, a whistleblower proceeding under either Act may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Connecticut

Connecticut False Claims Act, Conn. Gen. Stat. §§ 4-274 et seq.

The Connecticut False Claims Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Delaware

Delaware False Claims and Reporting Act, Del. Code tit. 6 §§ 1201 et seq.

The Delaware False Claims and Reporting Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state or its political subdivisions.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

District of Columbia

District of Columbia False Claims Act, DC code §§ 2-381.01 et seq.

The District of Columbia False Claims Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the District.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the District, or between 25% and 30% of the proceeds if the District does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Florida

Florida False Claims Act, Fla. Stat. §§ 68.081 et seq.

The Florida False Claims Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state or any instrumentality of the state.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Georgia

Georgia False Medicaid Claims Act, Ga. Code §§ 49-4-168 et seq.

Georgia Taxpayer Protection False Claims Act, Ga. Code §§ 23-3-120 et seq.

The Georgia Medicaid False Claims Act applies to cover fraud relating to the state’s Medicaid program and allows whistleblowers aware of violations to bring lawsuits for such fraud, subject to limitations on public employee whistleblowers who had a duty as employees to report or investigate the misconduct. The Georgia Taxpayer Protection False Claims Act applies more generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state or local governments, upon written approval by the Attorney General.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state or local government intervenes, or between 25% and 30% of the proceeds if the state or local government does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Hawaii

Hawaii False Claims Act (State), Haw. Rev. Stat. §§ 661-21 et seq.

Hawaii False Claims Act (Counties), Haw. Rev. Stat. §§ 46-171 et seq.

The Hawaii False Claims statutes work together to apply generally to cover many types of fraud and allow whistleblowers aware of violations to bring lawsuits for fraud against the state or its counties.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state or county intervenes, or between 25% and 30% of the proceeds if the state or county does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Idaho

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Illinois

Illinois False Claims Act, 740 Ill. Comp. Stat. §§ 175/1 et seq.

The Illinois False Claims Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state, its colleges, or any of its political subdivisions.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Indiana

Indiana False Claims and Whistleblower Protection Act, Ind. Code. §§ 5-11-5.5 et seq.

Indiana Medicaid False Claims and Whistleblower Protection Act, Ind. Code §§ 5-11-5.7 et seq.

Working together, Indiana’s false claims statutes apply generally to cover many types of fraud and allow whistleblowers aware of violations to bring lawsuits for fraud against the state or its agencies. The statutes do not apply to fraud against the state’s political subdivisions.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Iowa

Iowa False Claims Act, Iowa Code § 685.1 et seq.

The Iowa False Claims Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Kansas

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Kentucky

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Louisiana

Louisiana Medical Assistance Program Integrity Law, LA. Rev. Stat. §§ 46:437.1 et seq.

The Louisiana Medical Assistance Program Integrity Law applies to cover fraud relating to the state’s medical assistance programs, including Medicaid, and allows whistleblowers aware of violations to bring lawsuits for such fraud.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Maine

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Maryland

Maryland False Claims Act, Md. Code Gen. § 8-101 et seq.

Maryland False Health Claims Act, Md. Code Health-Gen. §§ 2-601 et seq.

Working together, Maryland’s false claims statutes apply generally to cover many types of fraud and allow whistleblowers aware of violations to bring lawsuits for fraud against the state or other government entity.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes. If the state does not intervene or withdraws its intervention, the case will be dismissed.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Massachusetts

Massachusetts False Claims Act, Mass Gen. Laws ch. 12, §§ 5 et seq.

The Massachusetts False Claims Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state or its political subdivisions.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Michigan

Michigan Medicaid False Claim Act, Mich. Comp. Laws. §§ 400.601 et seq.

Michigan’s Medicaid False Claim Act applies to cover fraud relating to sums of money paid by the state’s department of community health under the social welfare act (generally, Medicaid), and allows whistleblowers aware of violations to bring lawsuits for such fraud.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Minnesota

Minnesota False Claims Act, Minn. Stat. §§ 15C.01 et seq.

The Minnesota False Claims Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state or its political subdivisions. The Act contains an exception for fraud related to taxes.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Mississippi

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Missouri

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Montana

Montana False Claims Act, Mont. Code §§ 17-8-401 et seq.

The Montana False Claims Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state or its universities or political subdivisions.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Nebraska

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Nevada

Nevada False Claims Act, Nev. Rev. Stat. §§ 357.010 et seq.

The Nevada False Claims Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state or political subdivisions.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

New Hampshire

New Hampshire Medicaid Fraud and False Claims Act, N.H. Rev. Stat. §§ 167:58 et seq.

The New Hampshire Medicaid Fraud and False Claims Act applies to cover fraud relating to the state’s department of health and human services, including its Medicaid program, and allows whistleblowers aware of violations to bring lawsuits for such fraud. However, the statute restricts Qui Tam actions to those against defendants who are headquartered in New Hampshire or whose Medicaid reimbursement from New Hampshire equals at least 10% of all of its Medicaid reimbursement in the previous 12-month period.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

New Jersey

New Jersey False Claims Act, N.J. Stat. §§ 2A:32C-1 et seq.

The New Jersey False Claims Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state, its executive branch departments, and its commissions and instrumentalities, subject to limitations on public employee whistleblowers who had a duty as employees to report or investigate the misconduct. The Act contains an exception for fraud related to taxes.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

New Mexico

New Mexico Fraud Against Taxpayers Act, N.M. Stat. §§ 44-9-1 et seq.

New Mexico Medicaid False Claims Act, N.M. Stat. §§ 27-14-1 et seq.

Working together, New Mexico’s false claims statutes apply generally to cover many types of fraud and allow whistleblowers aware of violations to bring lawsuits for fraud against the state or its government entities and instrumentalities.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

New York

New York False Claims Act, N.Y. State. Fin. Law § 188 et seq.

The New York False Claims Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state or other government entities or local governments. The Act applies to tax law violations, but only if the violator’s annual net income or sales meet or exceed $1 million and the damages pleaded exceed $350,000.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

North Carolina

North Carolina False Claims Act, N.C. Gen. Stat. §§ 1-605 et seq.

The North Carolina False Claims Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state or any programs concerning money intended to be spent or used on the State’s behalf.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

North Dakota

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Ohio

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Oklahoma

Oklahoma Medicaid False Claims Act, Okla Stat. tit. 63, §§ 5053 et seq.

The Oklahoma Medicaid False Claims Act applies to fraud concerning money that is meant to be spent on the state’s behalf or to advance a state program or interest, and allows whistleblowers aware of violations to bring lawsuits for fraud against the state.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Oregon

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Pennsylvania

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Rhode Island

Rhode Island False Claims Act, R.I. Gen. Laws §§ 9-1.1-1 et seq.

The Rhode Island False Claims Act applies generally to cover many types of fraud and allows whistleblowers aware of violations to bring lawsuits for fraud against the state or its government agencies or political subdivisions. The Act contains an exception for fraud related to taxes.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

South Carolina

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

South Dakota

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Tennessee

Tennessee False Claims Act, Tenn. Code §§ 4-18-101 et seq.

Tennessee Medicaid False Claims Act, Tenn. Code. §§ 71-5-181 et seq.

Working together, Tennessee’s false claims statutes apply generally to cover many types of fraud and allow whistleblowers aware of violations to bring lawsuits for fraud against the state or its political subdivisions. The Acts contain an exception for fraud related to workers’ compensation or taxes.

If successful, a whistleblower proceeding under the Tennessee False Claims Act may receive between 25% and 33% of the proceeds or settlement of an action in which the state intervenes, or between 35% and 50% of the proceeds if the state does not intervene.

If successful, a whistleblower proceeding under the Tennessee Medicaid False Claims Act may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Texas

Texas Medicaid Fraud Prevention Act, Tex. Hum. Res. Code §§ 36.001 et seq.

Texas’s Medicaid Fraud Prevention Act applies to cover fraud relating to the state’s Medicaid program, and allows whistleblowers aware of violations to bring lawsuits for such fraud.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Utah

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Vermont

Vermont False Claims Act, Vt. Stat. tit., 32 §§ 631 et seq.

The Vermont False Claims Act applies generally to cover many types of fraud, and allows whistleblowers aware of violations to bring lawsuits for fraud against the state or its political subdivisions or government entities. The Act contains an exception for fraud related to taxes.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Virginia

Virginia Fraud Against Taxpayers Act, Va. Code. §§ 8.01-216.1 et seq.

The Virginia Fraud Against Taxpayers Act applies generally to cover many types of fraud, and allows whistleblowers aware of violations to bring lawsuits for fraud against the state or its political subdivisions or government agencies. The Act contains an exception for fraud related to taxes.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Washington

Washington Medicaid Fraud Act, Wash. Rev. Code §§ 74.66.005 et seq.

The Washington Medicaid Fraud Act applies to cover fraud relating to the state’s Medicaid program, and allows whistleblowers aware of violations to bring lawsuits for such fraud.

If successful, a whistleblower may receive between 15% and 25% of the proceeds or settlement of an action in which the state intervenes, or between 25% and 30% of the proceeds if the state does not intervene.

Additionally, whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

West Virginia

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Wisconsin

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.

Wyoming

Whistleblowers aware of false or fraudulent claims against the federal government or federally funded programs may bring an action under the federal False Claims Act. The federal law provides for successful whistleblowers to receive between 15% and 25% of the proceeds or settlement if the government intervenes, or between 25% and 30% if the government does not intervene.